Investment markets are dynamic and can be compared to a swinging pendulum. Your portfolio valuation will continuously change from being undervalued to being overvalued. There will be a time when it is just right and that is when the pendulum is at the six o’clock position. As the valuation changes from one extreme to the other, there will be many signs to warn you that things are getting too expensive or too cheap. Unfortunately we never know how far the pendulum will swing before it reaches its zenith.

As humans our psychology will follow this pendulum from greed to fear. If you look at the illustration below, you will recognize these emotions and it is fair to say that at the end of 2021 we were euphoric and now we are at the capitulation stage. The good news is that when we are where we are now, usually things will soon start swinging in the opposite direction again, lifting the valuations of our sad-looking portfolios.

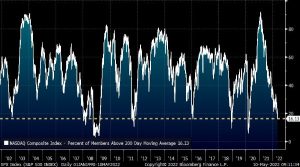

If we look at the graph below depicting the percentage of shares in the Nasdaq which are trading above their 200-day moving average, we can see that we are close to desperate times like 2020, 2018 and even 2008. At times like these, it would be foolish to sell any equities, and wise to start investing again if you have cash earmarked for the longer term.

The danger is that the pendulum may continue to swing to even worse levels and that any shares you buy now will be even cheaper in a month’s time. If you look at the graph below, you will see that we have lost all the returns for 2021 on the S&P500 index. It also shows that we can go much lower if we want to get back to 2020 levels. The good news is that the current indiscriminate selling of shares are dragging some high-quality companies down with the rubbish and even if they get cheaper after you have bought them, you will see very solid returns from them five years from now.

For things to improve a few things should happen first, namely:

- China should end their Covid lockdowns and open up the economy.

- Supply chain disruptions should ease up.

- The Russia/Ukraine conflict should be resolved, even partially.

- The rising interest rates should slow the price pressures on USA housing and wages, as well as energy demand.

There is a tremendous responsibility on the Federal Reserve in the USA. If they increase interest rates just enough to bring down inflation, we will see a very positive move in equity prices. If they overreact and increase interest rates too much, we will see the US economy going into a recession which may bring any relief rally in equities back down.