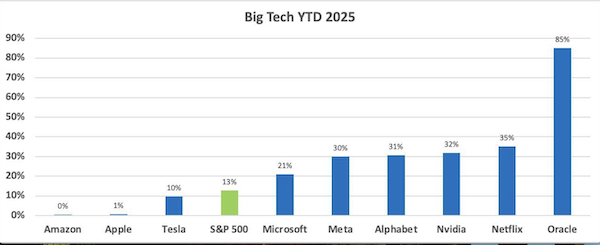

There are only three months left till the end of 2025 and we have seen some strong performances from equities, gold and the rand. If we do a quick recap, we see the broader equity market in the US up by 12% ytd and the big tech companies up by closer to 17%. For the big tech names the usual suspects are doing the heavy lifting as we can see from this graph borrowed from a Vestact newsletter.

Locally, the JSE All Share is up 26% driven by Resources which are up over 100% ytd. Gold is a big winner this year and is up 43%, hence the good performance of our gold-mining companies. It is no surprise that all the fans of gold are broadcasting far and wide that gold has outperformed the S&P500 over the last ten years with a return of 210% compared to the S&P500 return of 190%. Unfortunately, gold is a lumpy performer and has only given you 4% annual return since 1980, compared to 11% for the S&P500.

The rand is taking advantage of a slide in the US$ and is 7.7% stronger against the greenback. Unfortunately it is 4% weaker against the euro and pretty even against the pound. With the rand at around 17.40 against the dollar it is not a bad time to make some of those international investments you have been waiting for. As always, we cannot predict where the rand will go from here, and if things in South Africa were a bit more predictable and governed more intelligently, the rand would be much stronger than it is today. Unfortunately, international investors do not trust our economy and that is why South Africans have to pay R80 for a cup of coffee in Venice, for example.

On the interest rate front we are seeing rates coming down, but inflation staying elevated. This will hamper the pace of future rate cuts and we will just have to be patient. For those of you with cash in the bank or money market accounts, higher rates is a good thing but for those of you with debt, not so much. Our wish for the last three months of the year is for companies to continue reporting strong earnings growth; the rand to stay strong; and the oil price to remain contained. If we can just end this year with another double-digit investment performance it will not matter that much if 2026 is a year of consolidation, rather than growth.