There is a saying that goes: “You will never get rich renting out your time.” This refers to the fact that no matter how much you earn per hour working, it will not make you rich. Even if you are a medical specialist earning R300 000 per month, half of that will go to taxes and the other half will be spent on lifestyle, leaving you with no capital at the end of the year. What this scenario tells us, is that you will either have to work forever, or find some way of building up an investment portfolio to replace your hourly wages. You might wonder who in their right mind would spend so much money on lifestyle, without building up a significant investment portfolio on the side? It all boils down to discipline. There are many people who cannot help themselves when it comes to buying stuff now, with the intention of saving for retirement later in life. But sometimes the buy-now-and-save-later never materializes.

I can already hear your arguments: “So what is the definition of rich?” and “I never want to retire”. My response will be that rich is very subjective, but for the sake of this blog, rich means having more money than you can ever spend, even if you buy everything you want. Do you know of anyone earning just an hourly income that is close to being that rich? I do agree, though, that just “being rich” is not a very noble life purpose, and that working forever is a good thing because it gives us purpose.

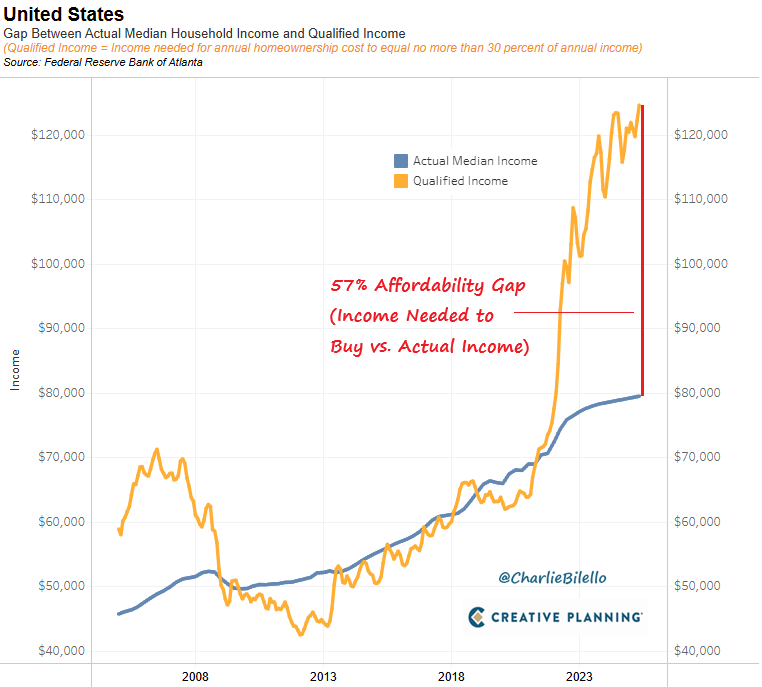

So what is the point of diversifying your income stream to include something that will provide you with enough money to at least pay your bills if you can no longer work, or if inflation overtakes your salary increases, making it difficult for you to pay your bills? If we look at the current housing problem in the USA, we see that there is a 57% shortfall in actual income versus required income to buy a house .

This is because of the spike in house prices over the last few years. We see the same problem in South Africa, where people living in Gauteng cannot afford to move down to Cape Town because of the cost of housing. This problem would not occur if you have an asset that keeps pace with the cost of living, i.e. shares.

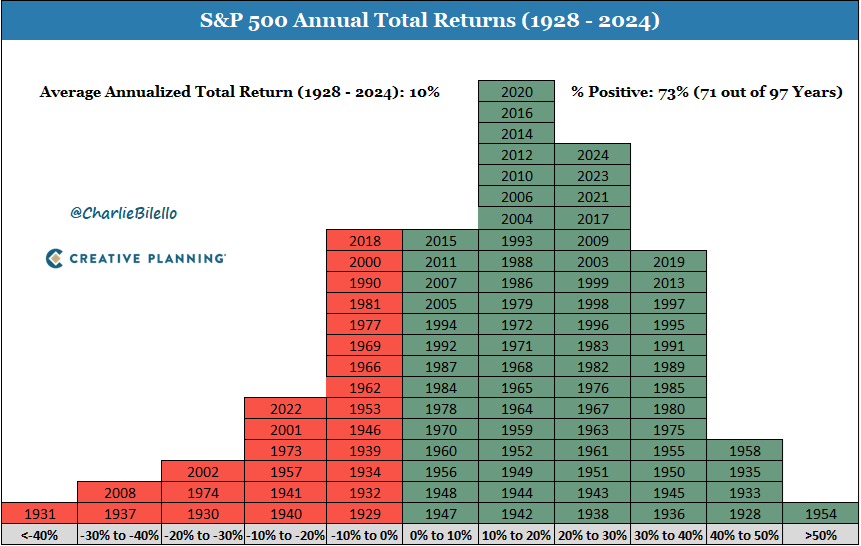

If we look at a graph of the compounding returns on equities, we see that it is very lumpy, with the average over the last 97 years being only 10% per year, but with 73% of the years being positive years.

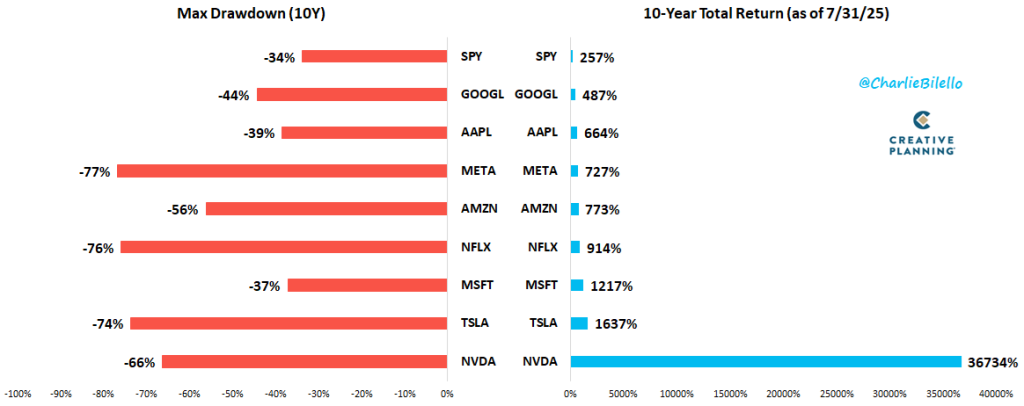

So if you were so unfortunate as to have been invested in the majority of the negative years and to have missed out on the majority of the positive years, your returns would have been mediocre. But if you had started investing during the 2000s, your returns would have outpaced even the worst inflationary increases in your lifestyle assets. If we turn our gaze towards the current investment universe, driven by the big tech companies in the USA, many investors fear the volatility they might experience by investing in these companies.

Your fears are justified when you look at only the negative returns over certain periods, but if you look at the whole picture, you would see that if you had endured the periods of negative returns on these shares, your ultimate rewards were spectacular. Looking at the returns of these companies over the last ten years, and taking Microsoft as an example, you can see that within those ten years the biggest fall in the Microsoft share price was 37%, but your total return over the ten years was 1217% if you didn’t sell.

The point is, if you can build up a source of passive income that is scalable, like a business, a property portfolio or share portfolio, the volatility you will face in those assets generating a passive income will be less risky than your reliance on your ability to earn an hourly wage.