The investment equivalent of the Boogeyman is the term “bubble”. When equity markets are performing very well, you will often hear people refer to it as being in a bubble. What they are trying to tell you is that just like when you inflate a soap bubble too much, it will pop. The natural reaction to such talk is to sell your shares before the dreaded pop, but is that the right thing to do? The first question you have to ask yourself is, “Who are making these statements?” In this day and age there are many news outlets competing for reader attention, resulting in a plethora of fake or overdramatized headlines. Paying any attention to these headlines without doing your own homework is not a good idea. Then you get the die-hard pessimists, who have never invested in equities because they always see a disaster around the corner; and don’t forget the sour-grapes investors who have missed the latest run in equities and cannot wait for the market to crash so that they can say, “I told you so!”.

What is more concerning, is when investment professionals start talking about a bubble. These are the people you trust and you expect them to know what they are talking about. Quite often though, when an investment professional is talking about a bubble forming, it is taken out of context, or misunderstood. When investing in equities one can expect a lot of volatility due to investor sentiment bouncing between greed and fear. Sometimes the reason for equities going down sharply can be explained by some unexpected bad event taking place, like the advent of Covid 19 in 2020; and sometimes they happen due to an underlying risk management event like the 2008 great financial crisis. These situations should not be called bubbles but rather by another favourite term in investment circles, namely a Black Swan event. The term bubble refers to the price of a share or an equity index going far beyond its fair value.

Currently the term bubble refers to the exceptional performance of technology companies around the world, the earnings of which are being driven by AI. The first mistake people make when reference is made to the bubble in equities, is to think that all the shares in the index are overvalued, and not only the technology companies. This is not the case. The 493 other companies in the S&P500 index, excluding the Mag7, are in fact fairly valued. So if you sell your investment in the S&P500, you sell cheap as well as expensive shares. The other mistake a lot of people make is to compare the current AI-driven technology companies to the unprofitable new internet companies of 2001, where there was a bubble that popped. The difference between now and 2001 is that the current Mag7 companies are super profitable, with tons of free cash and strong balance sheets.

Lastly, it would be sensible to listen to experts who are actually involved in the creation of the AI buildout, and not merely to an equity analyst who sits behind a computer screen, crunching the numbers of the last quarterly results. It might just be true that instead of the biggest and smartest companies in the world misallocating billions of dollars to AI infrastructure buildout and thus creating this huge valuation bubble in their stock prices as some people would have it; that they actually understand the paradigm-shifting technology they are developing, and that even if there are some of them that will go bust, the leaders are only at the start of something we cannot comprehend at this stage.

Perhaps the prudent way to go about dealing with bubble talk is to recognize the fact that investors are emotional beings and that they do push up the price of their favourite share beyond its fair value from time to time, resulting in a sharp fall when something negative happens. But instead of selling your investments, see this as an opportunity to buy some more of those companies with compelling futures with the cash you have taken off the top over time.

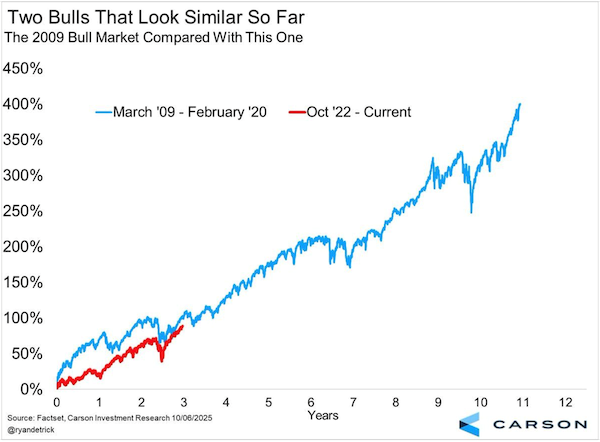

If you look at the graph below, you will realize that if you had listened to the bubble talk during the previous decade and sold your equity investments during any of the drawdowns, you would have made a big mistake.

If you want to talk about potential bubbles forming in the investment world, then you need look no further than gold companies currently. Anglogold is up 207% in ten months! We will look at gold next time, but for now consider this: if equities are considered expensive and they go up another 30% and then crash down 15%, you will still be 15% better off than the person who sold.