In 1999 a movie called The Matrix was released. It was a story about all of humanity living in an illusionary world called the Matrix, created by the AI robots, except for some rebels who managed to escape this Matrix and were fighting to liberate humanity and show them the truth. If you saw this movie, you will remember that the lead character, called Neo, was offered two choices. He could take a blue pill and go back to the illusion of the Matrix where he could live the rest of his life in a comfortable, yet illusionary world; or he could take the red pill and live in the real world, which was a constant battle, but at least it was reality.

With regard to investment, there are many people who prefer to stay ignorant because then they can remain in a comfortable place where they do not have to make changes which cause anxiety. If you look at the investment portfolios of these people, you will notice that they are predominantly invested in rand cash. They have been told about the currency protection they could get if they invested some of their money in dollars, and the superior returns they could get over the longer term if they invested some of their money in equities, but next year their portfolios will still be invested in their savings account.

If you decide to take the red pill, you will be shown a future world which will be scarcely recognizable to you. This world is probably still ten or twenty years away, but the vast majority of us will live to see it, and our children and grandchildren will live it. The good news is that you don’t have to understand this new world to benefit from it, you only have to invest in the companies creating it. As a JWR client you can also take comfort in the fact that we are aware of this changing world and so are the fund managers whose funds we are invested in. During a recent Coronation presentation some interesting and important points were made. One of the most important points was the following quote, originally by Seth Klarman in The Value of Not Being Sure (2009): “Amidst such uncertainty, people who are too resolute are hell-bent on destruction. Successful investors must temper the arrogance of taking a stand with a large dose of humility, accepting that despite their efforts and care, they may in fact be wrong.”

We can confidently predict that some of the companies we are invested in today, will benefit from the world of tomorrow, but we also have to admit that some of the companies we believe will be the leaders of a future world, will turn out to be duds.

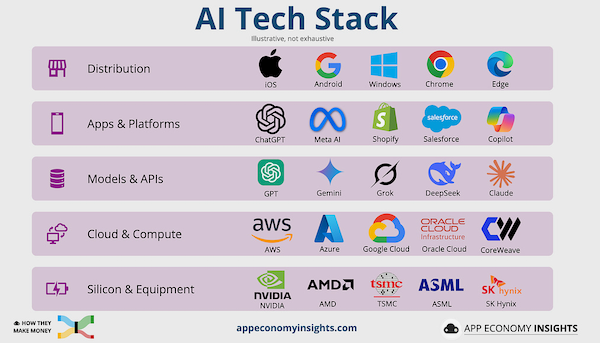

The accompanying slide shows us which companies dominated in 2000, and which companies are dominating now. If you have stuck with your investments in the 2000 list, you would have underperformed the people who have changed their portfolios to be more in line with the 2025 list, by a lot.

It is fair to say that not all investors should invest the same way. If you are in your 50s or 60s, your portfolio should look a lot different from someone in their 20s or 30s. For the former group of investors, it is more about wealth preservation, and for the latter group, it is all about wealth creation. If we take a quick look at the differences between these two groups, we see the following:

Group 50+ : The core of your portfolio should focus on diversifying your risk and ensuring the sustainability of your chosen lifestyle. Your exposure to investments in companies which will potentially dominate the world of tomorrow cannot be zero, but you have to be predominantly invested in the companies with proven profitability and offering higher certainty and quality right now. If you have spare capital to invest or you want to create a nest egg for your children or grandchildren, you can follow the investment strategy for the group of 20+.

Group 20+ : Except for the slice of your income earmarked for financing big-ticket items like a house or car, your longer-term capital can go to investments that will dominate the world of 2045 and beyond because you can digest a very high level of volatility and risk. A suggested portfolio does not have to be very complex with a lot of standalone shares, it could simply be investing in technology, which we know will be the dominating theme for the decades to come. Something like the Nasdaq100 index in the US should be sufficient to reap the benefits of the strongest technology companies in the world.

One could add a percentage to crypto currencies like Bitcoin, where institutional adoption has occurred but valuations are impossible, making it highly volatile. The last bit can be invested in standalone companies leading the way in groundbreaking products, like Eli Lilly is currently doing with their obesity drug development. Their injectable GLP-1 medication called Zepbound is injected once a week and the average weight loss is 23.6kg over 72 weeks. It is still essential, however, to discuss these investment choices with your financial advisor before making them.

If you are still young, you can invest in an index and forget about it because it is self-regulating as long as you invest in the right index, currently Big Tech. If you are older but have some capital you can lock away for future generations, the same index-investing will work for you, but the core of your portfolio should be focused on the here and now and on avoiding the pitfalls of overvaluation and over-exuberance. We can help you with all of these – as long as you are willing to take the red pill.