Retirement is a concept that has evolved from a sudden termination of work to a vague transition of activity. It has become popular to systematically diversify your sources of income as you grow older. When you are young and starting out in the business world, you are very focused on establishing yourself and building a career which requires a lot of focus, but as your savings pot grows, you can start investing in things that do not require your full attention. This can be a double-edged sword, and caution is advised.

Most of us start out with someone paying us a salary. As long as you do a good job, you get new money to make a living every month. As time goes by, some people start a business and generate their own salary; others invest in a property portfolio and get paid from that; and some people continue working for a company that pays them a salary. What all of these have in common is that new money is produced by the going concern and any bad investments made with surplus cash can be replaced by the monthly income generated. But what happens when you retire from your company, or sell your business or property portfolio? Suddenly your investment portfolio will become your “employer”.

It might not sound like a potential risk, but for some people it is very difficult to stick to their budget when the discipline of only receiving a certain amount of money every month is suddenly replaced by a big lump sum from which they can draw as much as they want. The biggest risk is drawing too much of your capital too fast. Think of it this way: every time you draw into your capital, it is like getting a salary decrease. If you start with capital of R1 000 000, drawing an income of 10%, you get R100 000. If you spend R200 000 of the R1 000 000 to buy a new car, you will only get R80 000 for your 10% income withdrawal.

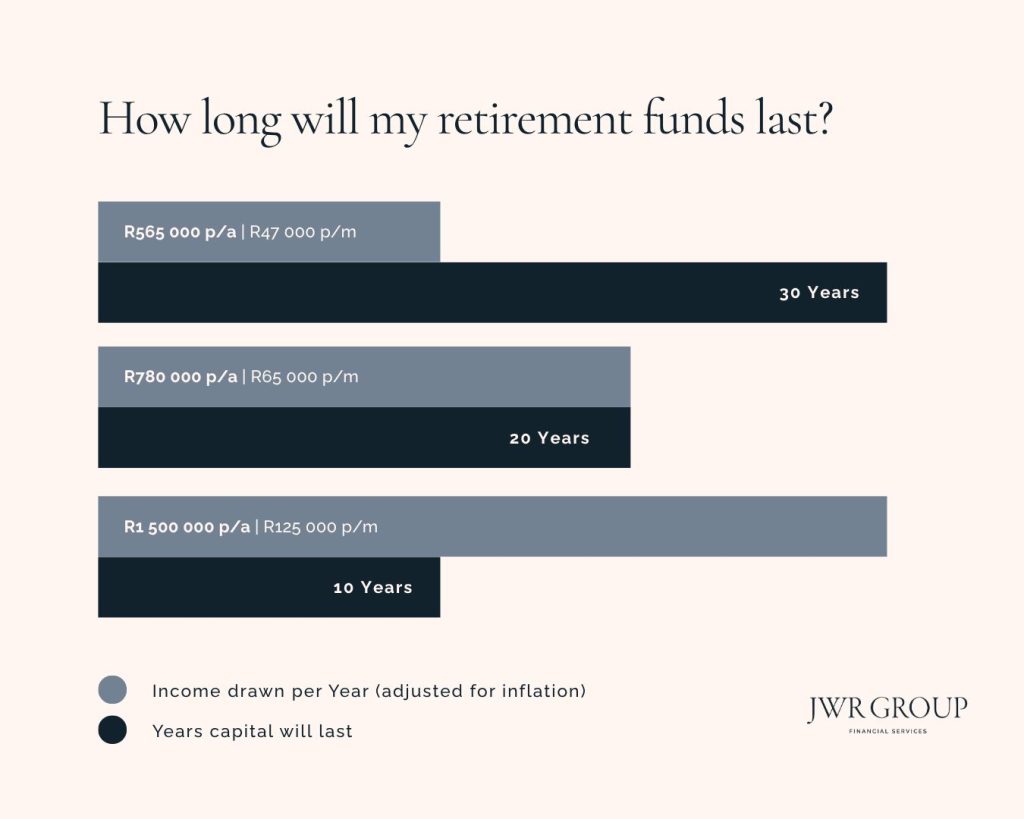

So how much of my retirement capital can I draw before I have nothing left? At JWR we can help you do these calculations, advise you as to what an appropriate amount would be, and also update these projections every year. But to give you an idea, let’s look at one example:

If you have retirement capital of R15 000 000 and get a return of 5% on it after tax and costs, with an inflation rate of 4%, your capital will last:

If you have only R12 000 000 retirement capital and you want to spend R47 000 p.m., your capital will last only 23 years. So you sacrifice seven years’ income if you decide to upgrade your house and spend an additional R3 000 000 on a new one at retirement.

The important thing to remember is that once you become reliant on your retirement capital alone, any permanent loss thereof cannot be replaced by an income earned from some other source.