When you are thirty years old, your chances of living another thirty years are very good. Your main driver of income is your salary, which is dependent on the type of work that you do, which is dependent on the skills you have acquired over the previous thirty years of your life. Your biggest financial risk is losing your job but chances are that it will be a temporary setback and you will find another job. During this period your biggest expenses would be housing and mobility. You will probably not have enough cash to buy a house or car, so the bank will provide you with the loans but it will cost you monthly repayments for which you will have to set some cash aside. You might get lucky and marry rich or inherit some money but as a rule your income will have to provide you with financial security. You know that you would like to replace the necessity to work with the luxury of choice when you turn sixty, so creating an investment portfolio that will make that possible is always in the back of your mind.

When you turn sixty, your chances of living another thirty years are quite good. Within the next few years your main driver of income will most likely be your investment portfolio, which will replace your salary. The extent to which your investment portfolio can provide you with an income will depend on how you invested during the previous thirty years. Your biggest financial risk is not the volatility in your portfolio, but the potential for one of your investments to suffer a permanent loss; like a company you are invested in going bankrupt, or money being stolen from your account. You must be debt-free so your only monthly requirements will be your chosen standard of living for which you will need a cash reserve. You might get lucky with one of your investments and make 1000 times your initial investment, but as a rule your returns will follow market averages. You know that as you grow older, you will become more financially vulnerable due to your exposure to medical inflation and care.

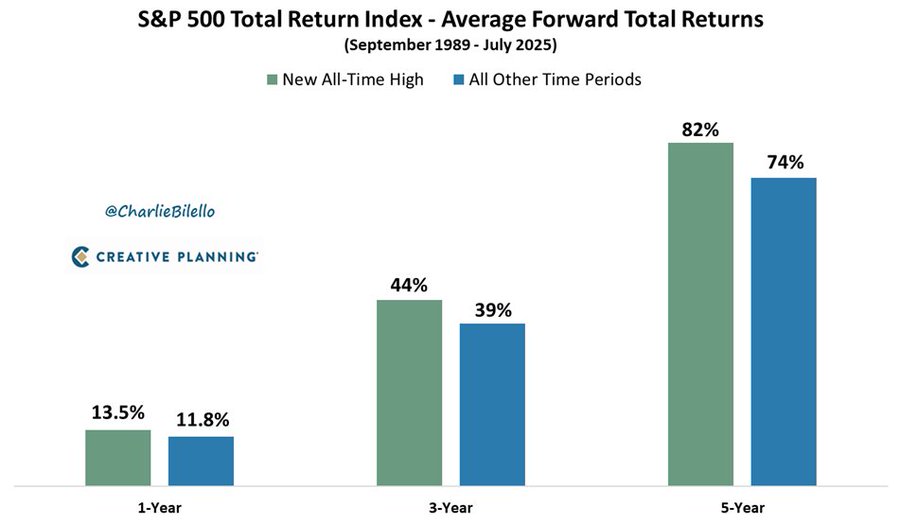

If you give this some thought, you will realize that investing at thirty and investing at sixty are very similar. The number of years you will still be alive will necessitate the inflation-beating returns provided by equities, and the cost of day-to-day living will require some cash reserves. The biggest risk you can take at thirty and at sixty is to shy away from investing in equities. With cash alone you will have no chance of beating the eroding cancer that is inflation. We have seen some tremendous returns in equities over the last few years, causing those investors who have missed it many reasons to frown, and those who have participated many reasons to smile, but one thing they have in common is the idea that equities are now too expensive or even in a bubble. I beg to differ. Historically, when the S&P500 traded at an all-time high, it offered better returns from that point for the next one, three and five years, compared to times when it didn’t, as we can see from the graph.

It must be clarified, though, that after the good returns we have seen over the last few years, and the elevated valuations in some parts of the market, you should be in the upper quartile of your desired cash holding. What we mean by this, is that taking some profits off the top by re-balancing your overall investment portfolio as it grows, is very important to provide you with the required liquidity as well as the opportunity to utilize surplus cash to buy equities when volatility causes the markets to come down again. We cannot time the market but we can be rational when it comes to asset allocation.

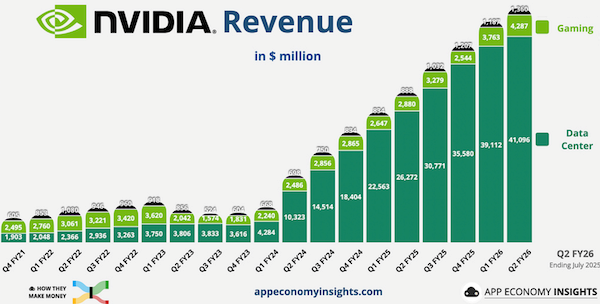

Another common mistake investors currently make is to compare the so-called Dot-Com Bubble in 2001 to the stellar performance of AI-driven stocks in the so-called Magnificent 7 companies. The difference is that during the 2001 bubble, the rise in the stock market was due to small start-up technology companies that generated no profits. They went bust when the capital financing them ran out. Today, the Mag 7 companies are super profitable with billions of dollars in free cash and revenue growth that makes your eyes water. If you look at the graph of the biggest company in the world and the leading company in AI, namely Nvidia, you can see what their revenue growth looks like.

The conclusion is that whether you are thirty or sixty, the likelihood of your still being alive in thirty years’ time makes it imperative for you to be invested in equities alongside your cash. There are subtle nuances when it comes to the mitigating of investment risk but that is something we can help you with. There will be many boom and bust stories in decades to come, as there have been in decades past, but one thing is certain: the future will be dominated by companies that are currently in the beginning stages of creating that world, and cash is not one of them.