Equity markets worldwide have been performing very well lately. European equities are climbing steadily and Chinese equities are recovering nicely after a bad stretch after 2022. The markets we want to focus on here, are the US and South African markets. For a long time, the JSE All Share index didn’t do very well. Resources companies, as well as companies doing business predominantly inside the SA economy, underperformed the S&P500 index. One might wonder why this has been the case and when we dig a little deeper, things become a little bit clearer.

If we start with the South African market, we see a stellar performance so far this year. The JSE All Share index is up a whopping 21%, but what are the main drivers of this performance? The answer lies in Resources companies (up 67% for the year), and Naspers/Prosus (up around 40% for the year). The SA economy is driven by resources. We export a lot of copper, iron ore, coal, platinum and related products and when the world economies are in a downturn, the demand for these resources declines. This leads to an underinvestment in these operations; which leads to a decline in supply; and eventually, when world economies start to grow again, the demand will be higher than the supply and resources will flourish again. The other problem we have is a political one. Even if there is a high demand for our resources, but state-run companies like Transnet and Eskom are broken, we cannot get the product to the market. The other outperformer this year has been Gold, and our gold producers are having a ball.

The question is: will this last? If we look at resources, we have to understand that the demand is cyclical and this outperformance will not last. If we look at Naspers and Prosus, we have to take into consideration that they are tied to Tencent, a technology company in China; and as we have seen in the past the Chinese government can make or break a company. At least, via Tencent, Naspers/Prosus are operating in the right sector. Lastly we have to consider what will happen to the price of gold. Gold is a very lumpy performer. The price of gold can stay suppressed for long periods of time and then suddenly spike to new all-time highs, as we are experiencing now. As the debt levels of countries like the US turn their currency into something approaching “Monopoly money”, the demand for gold will be supported by governments and investors trying to hedge their investments against a collapsing dollar.

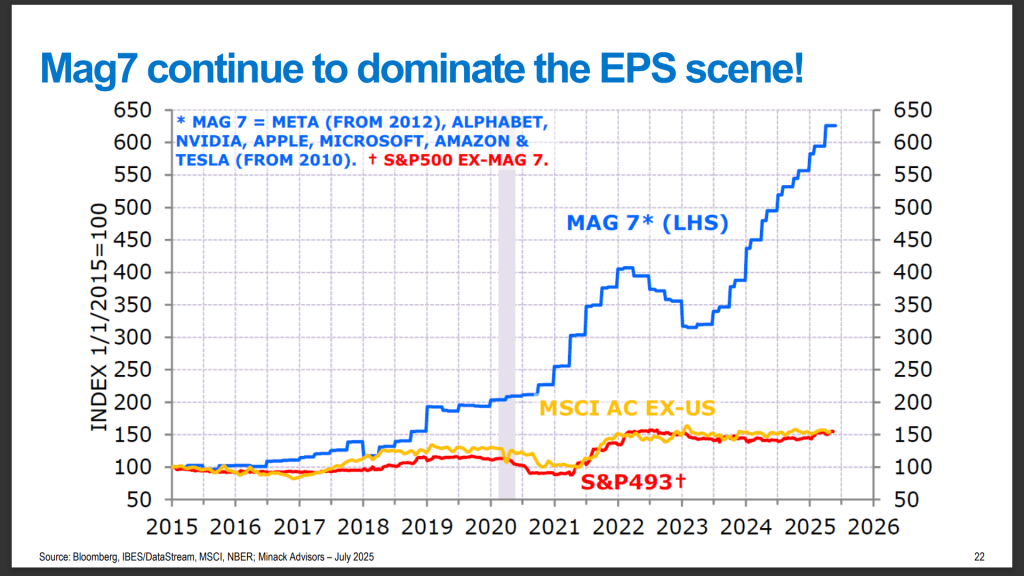

If we turn our attention to the USA, we see that they have been the outperformer over the last decade or so, but the truth is that this outperformance has been driven by big technology companies, not the smaller and mid-cap companies. To emphasize this point, we only have to look at the growth in the earnings per share of Mag7 companies in the slide below, to understand why they have dominated the share performance universe.

It is clear that the S&P493, i.e. the other 493 companies in the S&P500 index, have not contributed much. Will this US outperformance last? If you consider the fact that we are in the beginning stages of a new technological revolution called Artificial Intelligence, the probability of this outperformance lasting is very high. We are entering a phase where there will be hundreds of smaller companies popping up which will either support, provide, or develop AI services. Of these companies, some will become billion dollar ventures, but the majority will fail.

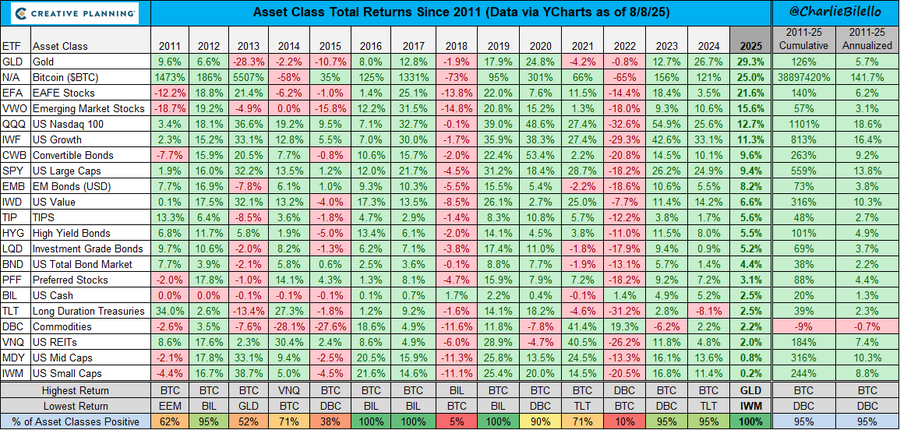

If we look at the graph below, we can see where the money has been made over the last fifteen years.

It has not been in gold or emerging markets, it has been in technology companies in the USA. So if we venture our best guess, we would say that the South African equity market, driven by resources and gold, will come and go. Gold will remain lumpy, with periods of underperformance. The future champions will be those companies that can capture the market in AI; whether by creating new products, supplying the data centres, providing the power, or manufacturing the microchips. AI will be the kingmaker for decades to come and the country that can dominate that space will be the world superpower.