A strong argument can be made that humans are the dominant species on planet Earth. It is highly likely that, if we are visited by beings from another planet, they will make contact with us before they do so with any other life forms on Earth. It is rather amazing that we have managed to become the dominant species if you take into consideration how volatile we can be, and how easily we could have wiped ourselves – and indeed most if not all life – off the face of the Earth over the last couple of centuries!

So what is the secret to our success? You may have your own theories but one worth considering is the fact that we always build on the knowledge and wisdom of our ancestors. Thousands of years ago someone realized that if you sharpen a heavy stick and throw it, you could kill a deer without getting close. The next generation built on that idea by tying a sharpened piece of rock to the tip of the stick to make it more durable – and so on and so forth.

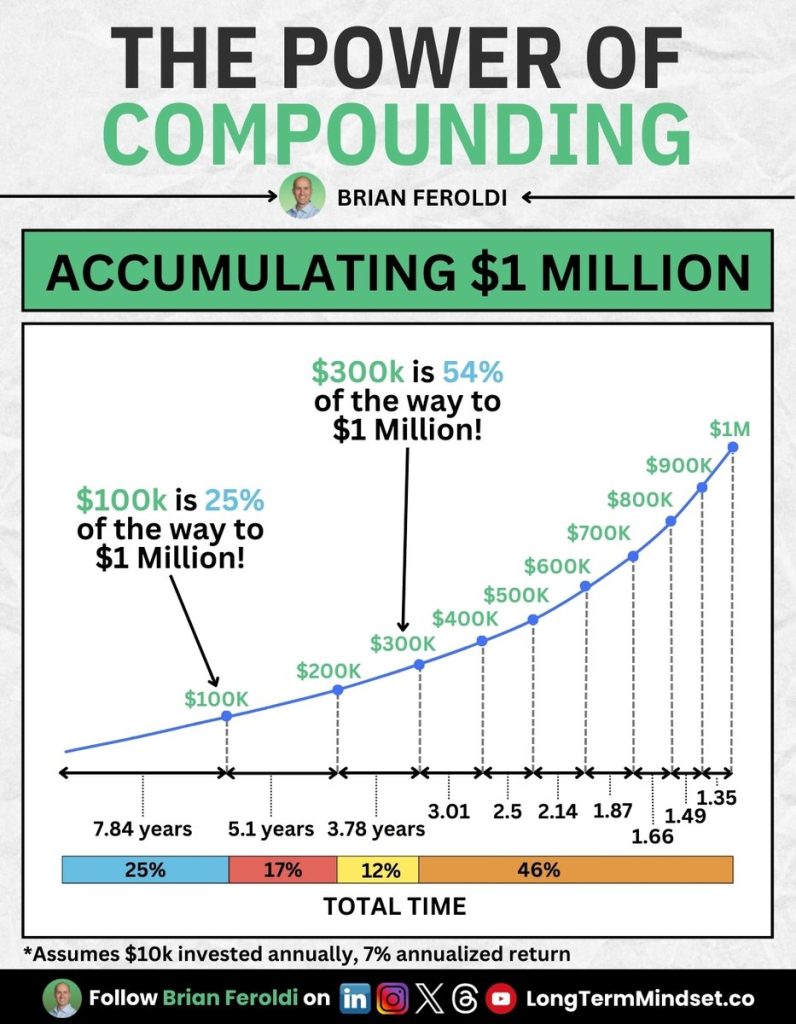

When it comes to investing, building on a base becomes even more powerful, especially if you give the effects of compounding time to do its thing. Consider the graph below.

You will notice that the time it takes for your investment to gain another $100 000 gets shorter and shorter, due to the effect of earning returns on your returns.

Another powerful way to look at this is what we like to call “the point of no return”. If you need R240 000 income per year but you have an investment of only R1,5 million, you will need a return of 16%. To get this type of return is very difficult and you will have to be either lucky or take on a lot of risk with leveraged equity investments. If your investment grows to R3 million, however, you need only an 8% return. So now we are looking at a much lower-risk equity index return if we have to consider tax and inflation eroding the purchasing power of our required R240 000 annual income. The point of no return will kick in when you have accumulated around R7,5 million. With this investment you need a return of only 3,2% to generate your required income. This type of return can be generated by a risk-free money market account, and you will start generating surplus income which can be added to your capital.

For the most part we do not have to think out of the box, or invest in complex structured products to get to a point in our lives where we do not have to take care of our investments, but where our investments will take care of us. All we have to do is consistently build on what investors before us proved to be a successful way of investing.