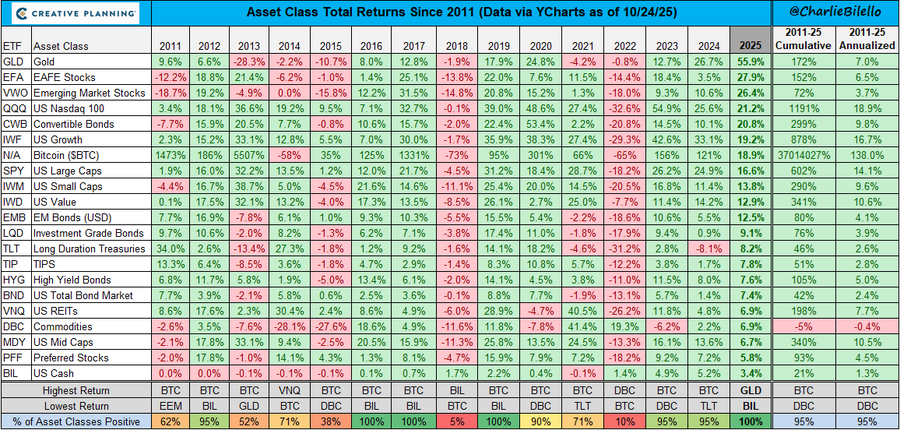

They say that someone with nothing worries less than a person with a lot. It is then no surprise that we are receiving so many queries from clients regarding the sustainability of their current investment performance. For the current year to date, local equities are up 30%, Gold is up 53%, gold companies are up north of 100%, US tech companies are up 22%, Chinese companies are up 31% and even European companies are up 16%. The longer-term average return for equities is around 6% above inflation, so we look at a 10% longer-term average return on South African equities and a 9% average return in dollar for equities in the US. It is understandable for investors to worry about the sustainability of the current equity returns if we look at them in isolation, but if we zoom out a bit, we see that the averages over a longer term after the recent good performance is not that high, except for US large caps (slide).

It is a fact that the last 3-year returns for US equity markets have been above average, but one can argue that the SA shares are only playing catch-up after a dismal ten years. To understand the current valuations a bit better, we should look at what is driving them.

- If a company generates good earnings and specifically good growth in the earnings, investors are happy to pay more for that share. If we take an example of a share trading at $100 with earnings of $10, we have a price-to-earnings ratio (PE) of 10. It will take ten years for that share to give you back your initial investment. If that share can grow the earnings at, say, 20% per annum, it will only take 5.4 years to get your initial investment back. It is clear that the growth in earnings is the bedrock of the value placed on a company. So if we look at the question we receive most often, regarding the sustainability of the Mag7 companies’ stellar performance, we can do the same calculation. With a 30.6 PE and earnings growth rate of 15.9%, it will take eleven years to get your initial investment back, which is not too bad for companies that are actually changing the way we live.

- Another factor to look at when evaluating the price of a share, is its momentum. There is a saying in the investment world that goes “the trend is your friend”. If the majority of investors are buying something, it is very dangerous to bet against that momentum, even if it is misplaced buying confidence. If you think that the momentum is pushing the price of a share above its fair value, it is better to take a little profit every now and then, rather than to sell it completely. There are many investors who have prophesied that the US market is in a bubble for the past three years. They are pulling out their hair at the moment.

- A third point to consider is the length of time you make the investment for. Unless you are invested in a share that is really ridiculously overvalued with no earnings support – something called a “meme stock” and owing its popularity to social media – it might be better to just ride out the volatility because the price will be higher five to seven years from now.

To answer the question regarding how worried you should be about your investments performing so well, it is fair to say that technology companies in the USA have been running hot for the last three years and caution is needed. Stop listening to people who call it a bubble, but do pay attention to the reasons for their performing so well. It is a fact that their earnings will have to slow down some time, and that the momentum will wane when that happens. If you are an active trader it might be a good time to take some profits, wait for a correction and then buy some more; but if you are a longer-term investor, just make sure you have sufficient cash as per you financial plan, make sure that your medium-term allocation is well diversified away from equities, and leave the longer-term allocation free to ride the waves of volatility.