In our previous blog we talked about bubbles and how to think about them. We mentioned that in our blog for this week we would talk more about the astronomical performance of gold this year and what to make of it, so let’s have a look. (note: since the writing of this blog gold is 5% lower and gold mining companies around 7% lower.)

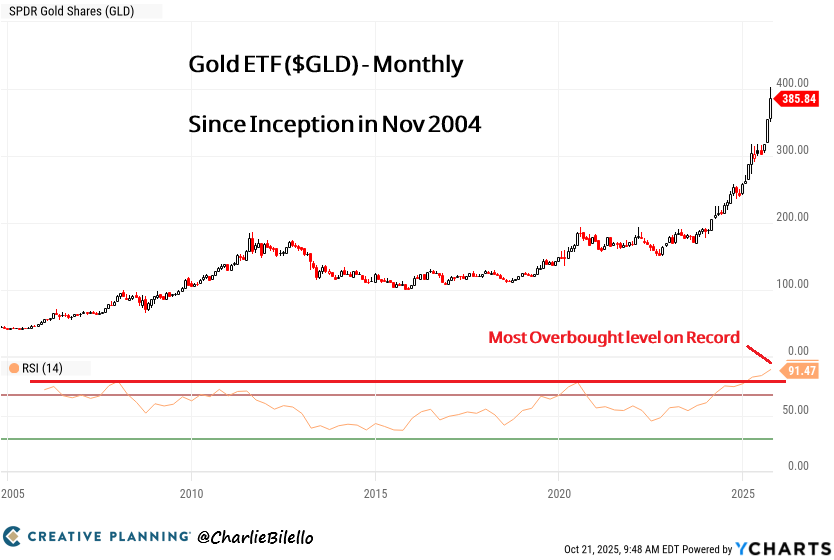

To be honest, I don’t know where to begin. On 1 January 2021 the gold price was $1894, three years later on 1 January 2024 it was $2065. That is a mere 3% per year return. On 20 October 2025 the price hit an all-time high of $4356, a 111% increase over a period of only 22 months. Even the biggest supporters of gold didn’t expect to see this exceptional performance over such a short period of time. If you look at the graph, you will see that it is also at the most overbought level it has been since 2004.

To take this point a little bit further, we can look at the shorter-term performance. On 8 August 2025, gold was up 29% for the year to date, on 20 October 2025, it was up 66% for the year to date. But that is not the most amazing thing about gold. If you look at the gold mining companies, you see something even more unreal: they are up over 200% for the year to date!

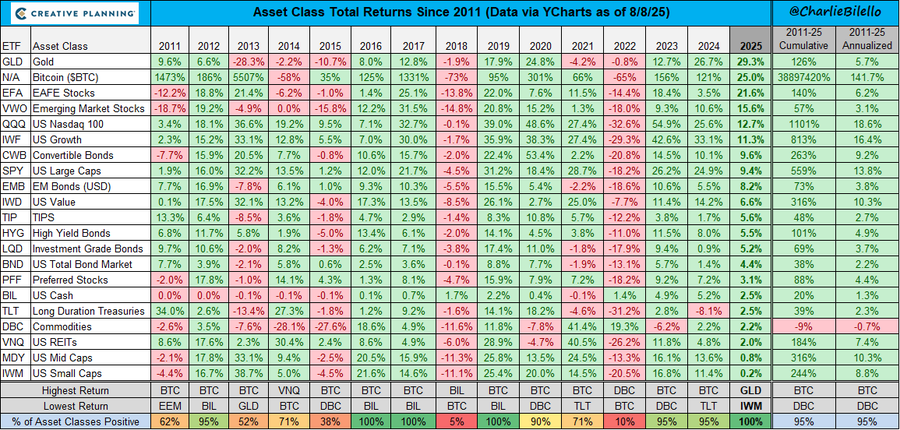

Is that normal? Heck no! If you look at the longer-term performance of gold you will see that it is very lumpy, with some periods having stellar returns and then collapsing to a very pedestrian return for several years. The average return for gold since 2011 has been only 5.7% per year if you exclude the latest spike (see graph).

The question we all have, is why the sudden interest in gold? Gold has always been considered a safe haven in times of geopolitical tension, rampant inflation or investment uncertainty, but something has changed over the last few years that might be a structural change in the way gold is perceived, and that change is the way the USA is weaponizing the dollar. Because the majority of trade world wide is done in dollars, most countries have billions of dollars in their foreign currency reserves tied up in US$. Most countries have a lot of assets in US$ and if they want to convert these assets into something else, they have to sell these dollars back to the US. Then we saw Russia invading Ukraine in 2022 and the USA froze these dollar assets Russia held; and countries like China, Iran and friends took notice.

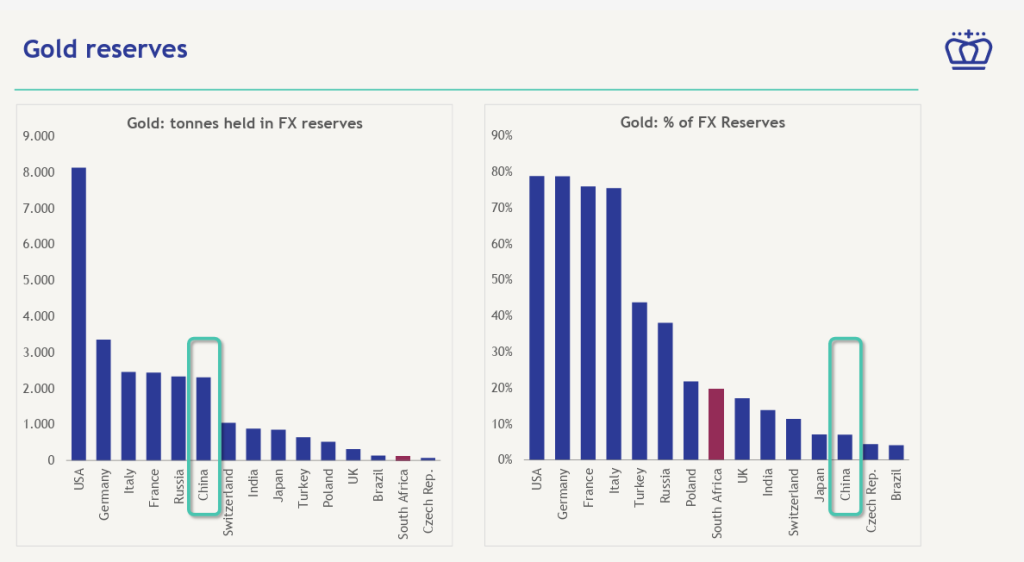

Central banks, including China, have been buying gold since 2023 and selling their dollars because they realized that they were very vulnerable due to their dependence on the US$. This caused the price of gold to start rising and in 2025, the general public woke up to this fact and started buying gold at a pace that can only be described as feverish. China and friends want to create an economy that can function independently from the West, and to do this they have to create a currency that can challenge the dominance of the US$ when it comes to world trade. One of the important things they have to consider, is convincing the rest of the world that this new currency is trustworthy, and the best way to do this is to back the currency with something widely accepted as a reliable store of value, like gold.

If you are considering gold as an investment, you have to be sure that the price of gold will not only go up from these levels, but also that central banks will keep on buying it. If we look at the current foreign currency reserves (FX reserves) of gold held by central banks, we see that China has a lot of scope to buy more (graph below).

So if the theory is correct that China and friends want to create a currency backed by gold to challenge the dollar, there might be an investment case to be made for the investment in gold going forward. BUT, due to the sudden and violent interest in gold by retail investors like you and me, a lot of volatility can be expected over the shorter term and buying the dips over a longer period might be advisable. If there is no intention from China to create this alternative currency, then you might see gold reverting back to a store of value in times of uncertainty with no yield and mediocre returns.

Let us conclude this discussion with the following three points:

- Gold might be experiencing a structural change due to the intention of China and friends to move away from the US$ and create an alternative trading currency backed by gold. If this is the case, gold can become a good investment with a portion of your portfolio. Gold might also be a good investment if the debt levels in countries like the USA keep on rising and the value of the $ keeps on falling. If these two conditions do not materialize, gold is not such a good investment. But, rather stay away from gold mining companies. They are notoriously bad at allocating capital when things go well, like now, and have unpredictable operational risks.

- Bitcoin is another new asset class that might play a very important role in the future. We have seen spectacular returns from it and once again it is driven by an expectation that traditional forms of payment like the dollar, euro, yen, etc., will be replaced by a digital, decentralized store of value and even currency. This might also be an assumption that turns out to be overhyped.

- Lastly we have seen the stellar returns of big tech companies in the US and elsewhere driven by the advent of AI. If the billions of dollars spent on the buildout of the infrastructure for this new technological revolution cannot be converted into profits, these shares, including the Mag7, will deliver poor or even negative returns going forward.

As an investor, you have to think deeply about these three asset classes and decide on the percentage holding in your portfolio. You won’t have to wait long for the outcome. By 2030 we will have a very good idea as to what worked and what didn’t.